Housing supply

Housing supply refers to the number of homes available for sale or rent in a particular market at a given time. It includes both newly constructed homes and existing homes that are listed for sale or rent.ped cool off the peak frenzy of buyer demand. But what you may not realize is, that actually could benefit you.

Inventory

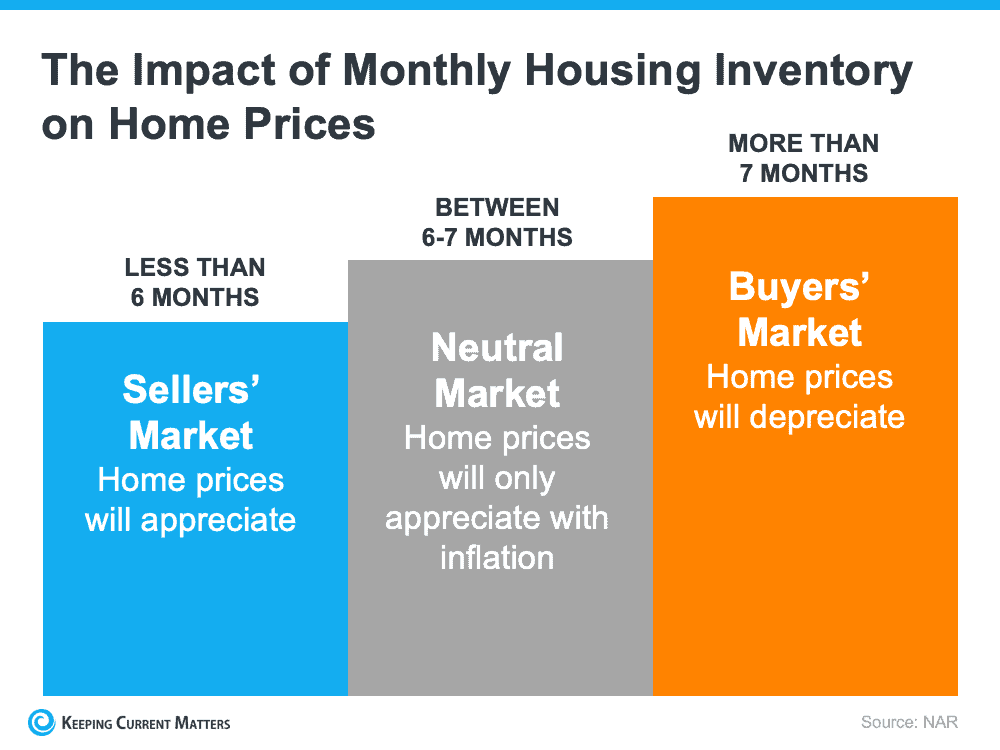

Inventory, in the context of the housing market, specifically refers to the number of homes available for sale. It represents the total stock of homes that are actively listed on the market and available for purchase by potential buyers.

Impact on Inventory

When the housing supply increases, either due to new construction or more existing homes being listed for sale, the inventory of available homes on the market also increases. This means there are more options for potential buyers to choose from.

Conversely, when the housing supply decreases, perhaps due to a lack of new construction or fewer existing homes being listed, the inventory of available homes on the market decreases. This can lead to a situation where there are fewer homes available for sale, which may result in increased competition among buyers and potentially higher prices.

A balanced housing market typically has a relatively stable level of inventory, where the number of homes for sale meets or closely matches the demand from potential buyers. However, when there is a significant imbalance between supply and demand, such as a shortage of homes relative to demand, it can lead to competitive market conditions and upward pressure on prices.

In summary, the housing supply directly impacts the inventory of available homes on the market. Changes in the housing supply can influence market dynamics, including pricing, competition among buyers, and overall market activity.