Are you haunted by fears and misconceptions about today’s real estate market? Don’t be spooked – let’s shed some light on the myths and provide you with the facts you need to navigate the housing market confidently.

Myth: If I have student loan debt, I can't buy a home.

Fact: Many people can still buy a home, even if they have student loans

It’s a common belief that student loan debt can be a barrier to homeownership. However, the truth is, buying a home with student loans is not only possible but quite common. In fact, experts confirm that you can still achieve your homeownership dreams even if you carry student loan debt. According to Apartment Therapy, a significant 40 percent of first-time homebuyers have student loan debt, proving that it’s not an insurmountable obstacle.

While student loans can impact your debt-to-income ratio, lenders take various factors into account when evaluating your eligibility for a mortgage. So, having student loans shouldn’t discourage you from exploring the housing market.

Myth: Home prices were going to crash in 2023.

Fact: The data proves, nationally, that home prices are not crashing. They're actually rising again after only a slight dip.

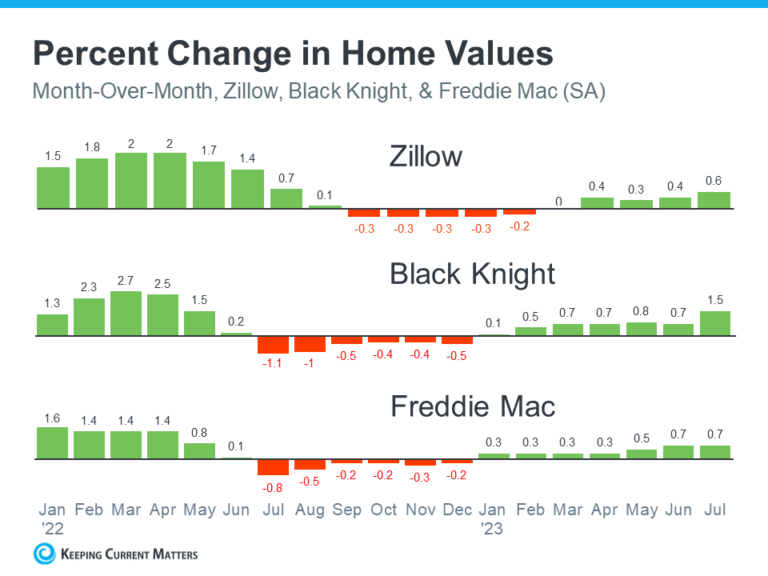

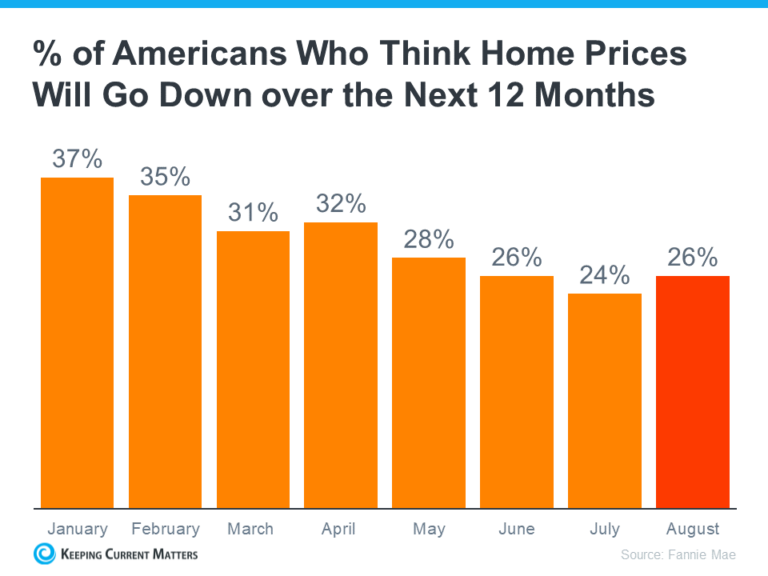

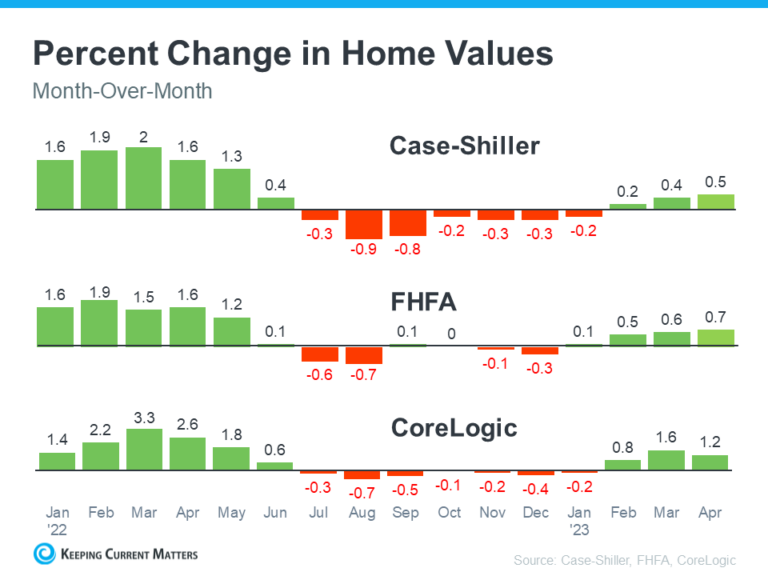

Worrying about a potential crash in home prices is a common concern among homebuyers. However, it’s essential to separate fact from fiction. The data indicates that nationally, there isn’t a housing market crash on the horizon. In reality, home prices are steadily rising again after experiencing only a slight dip.

While local markets may vary, the overall trend is positive. This means that you can still find great opportunities in today’s housing market without the fear of plummeting prices.

Myth: I have to put 20% down when I buy a home.

Fact: You usually don't have to save 20% for a down payment, unless specified by your loan type or lender. According to NAR, the median down payment is lower than that.

The 20% down payment myth has discouraged many potential homebuyers. However, this myth couldn’t be further from the truth. In most cases, you do not need to save a full 20% down payment. Mortgage options are diverse, and down payment requirements vary depending on your loan type and lender.

According to the National Association of Realtors (NAR), the median down payment is typically lower than the 20% often cited. There are programs and loan options available that require as little as 3% to 5% down, making homeownership more accessible than you might think.

If these myths aren’t your only fears or reservations about buying a home today, there’s no need to fret. A real estate professional can help address your concerns and provide guidance tailored to your unique situation. Don’t let myths and uncertainties cast a shadow on your homeownership dreams.

Bottom Line

The housing market can seem scary with all the myths and misconceptions floating around. However, by arming yourself with the right knowledge and a reliable real estate expert, you can confidently navigate the market and make your homeownership dreams a reality. Don’t let unfounded fears hold you back – take the plunge into the exciting world of real estate, where opportunities abound for informed and motivated buyers.

Article Source: www.keepingcurrentmatters.com

Buyers Strategy

Get Educated

I can help you find a strong buyer strategy that fits your goals. If you consider buying a property in the next 1-2 years, you need to download our free buyer guide!

Get informed with our buyer guide to understanding the best buyer strategies to get started.