If you’re following the news today, you may feel a bit unsure about what’s happening with home prices and fear whether or not the worst is yet to come. That’s because today’s headlines are painting an unnecessarily negative picture. If we take a year-over-year view, home prices did drop some, but that’s because we’re comparing to a ‘unicorn’ year when prices peaked well beyond the norm.

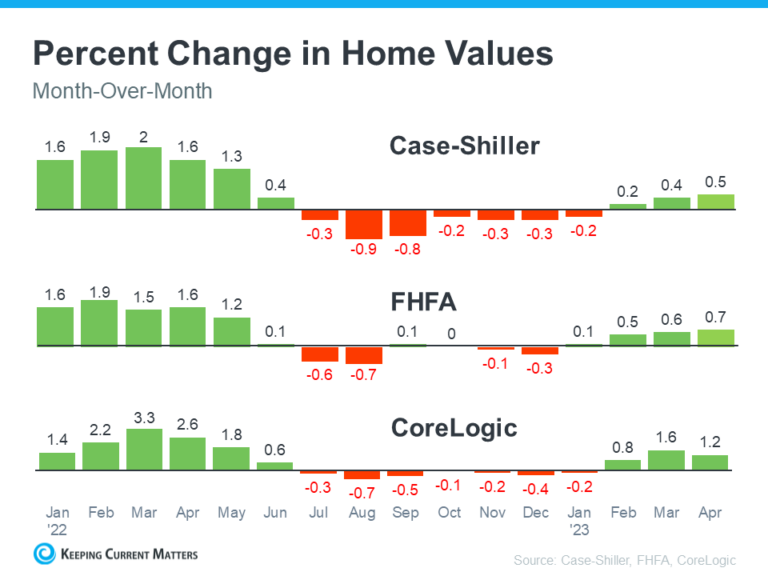

To avoid an unfair comparison to that previous peak, we need to look at monthly data. And that tells a very different and much more positive story. While local home price trends still vary by market, here’s what the national data tells us.

Looking at this monthly view, we can see the past year in the housing market can be divided into two parts. In the first half of 2022, home prices were going up, and fast. However, starting in July, prices began to go down (shown in red in the graphs above). By around August or September, the trend started to stabilize. But, looking at the most recent data for early 2023, these graphs also show that prices are going up again.

The fact that all three reports show prices have been going up for three or more straight months is an encouraging sign for the housing market. The month-over-month data indicates a national shift is happening – home prices are rising again.

Craig J. Lazzara, Managing Director at S&P Dow Jones Indices, says this about home price trends:

"If I were trying to make a case that the decline in home prices that began in June 2022 had definitively ended in January 2023, April’s data would bolster my argument.”

Experts believe one of the reasons prices didn’t crash like some expected is because there aren’t enough available homes for the number of people who want to buy them. Even with today’s mortgage rates, there are more people looking to buy than there are homes available for sale.

Mark Fleming, Chief Economist at First American, explains how more demand than supply keeps upward pressure on prices:

“History has shown that higher rates may take the steam out of rising prices, but it doesn’t cause them to collapse entirely. This is especially true in today’s housing market, where the demand for homes continues to outpace supply, keeping the pressure on house prices.”

Doug Duncan, Senior VP and Chief Economist at Fannie Mae, states home price growth is exceeding expectations thanks to that high demand

“. . . housing prices continue to show stronger growth than what was previously expected . . . Housing’s performance is a testimony to the strength of demographic-related demand . . .”

Here’s How This Affects You

• Buyers: If you’ve been holding off on buying because you were worried the value of your home would go down, knowing home prices have bounced back should bring you some relief. It also gives you the opportunity to own something that usually becomes more valuable as time goes on.

• Sellers: If you’ve been waiting to sell your house because you were concerned about how changing home prices would affect its value, it might be a good idea to team up with a real estate agent to list your house. You don’t have to wait any longer because the latest data suggests things are turning in your favor.

Bottom Line

If you delayed your moving plans because you were concerned about home prices dropping, the latest data reveals the worst is already over, and prices are appreciating nationally. Partner with me so you know what’s happening with home prices in your area.

Article Source: www.keepingcurrentmatters.com